As a CPA and accountant at Bhundhoo Tax in London, Ontario (the heart of the Forest City), I've consulted with hundreds of Canadian business owners over the years. Whether they're searching for an "accountant near me," a "virtual accountant," a fractional CFO, or expertise in compilation engagements, corporate tax, income tax, or tax planning, the conversation always starts the same way.

I ask for three key financial numbers before diving into any growth strategy, tax optimization, or scaling plans.

Why these three? Because ambitious goals mean nothing without a solid financial foundation. These metrics reveal instantly if your business is healthy enough for expansion—or if we need to address weaknesses first, like cash flow gaps or inefficient pricing.

At Bhundhoo Tax, we specialize in helping small and medium-sized enterprises (SMEs) across Canada, including local businesses in London, Ontario, with proactive tax planning, corporate tax strategies, and financial insights. As your virtual accountant or fractional CFO, we use these numbers to deliver tailored advice, from compilation engagements to maximizing deductions under the Income Tax Act.

In this in-depth guide, we'll explore each metric: what it is, why it matters, how to calculate it, Canadian benchmarks, common pitfalls, and improvement tips. Knowing these will empower you to make smarter decisions and position your business for sustainable success.The First Number: Your Gross Profit Margin

Gross Profit Margin = (Revenue - Cost of Goods Sold) / Revenue × 100

This percentage shows what's left from revenue after subtracting direct costs (materials, direct labour, inventory). It measures core operational efficiency before overhead like rent or marketing.Why It's the Starting Point

A low gross margin signals problems like underpricing, rising supplier costs, or production inefficiencies. No sales volume can compensate if you're barely profitable per unit. Many owners focus on top-line growth while ignoring eroding margins.

In tax planning, strong margins provide flexibility for investments qualifying for deductions like Capital Cost Allowance (CCA) or SR&ED credits.Canadian Benchmarks and Insights

Gross margins vary by industry. Service-based businesses often hit 50-70%, while retail or manufacturing averages 20-40%. The Business Development Bank of Canada (BDC) stresses tracking it against peers and over time source: BDC - Gross Profit Margin Ratio.

Innovation, Science and Economic Development Canada (ISED) offers detailed industry data via its Financial Performance Data tool source: ISED Financial Performance Data.

For London, Ontario businesses in trades or retail, margins below 30% often indicate pricing pressure from competition.

How to Improve Your Gross Profit Margin

Review pricing → Ensure it covers costs plus a healthy markup.

Negotiate with suppliers → Seek volume discounts or alternatives.

Streamline operations → Reduce waste or outsource non-core activities.

Track regularly → Use tools like QuickBooks for real-time insights.

The Second Number: Your Current Ratio (Working Capital Health)

Current Ratio = Current Assets / Current Liabilities

This gauges short-term financial stability: Can you cover upcoming bills with liquid assets (cash, receivables, inventory)?Why It Matters for Strategy

Growth demands cash for inventory, hiring, or marketing. A low ratio risks reliance on expensive debt or missed opportunities. Many profitable businesses falter due to liquidity issues, especially with delayed payments.

From a corporate tax perspective, a healthy ratio supports claiming the Small Business Deduction confidently, as it shows operational strength.Canadian Benchmarks

BDC recommends 1.2 to 2.0 for most SMEs, with at least 1.0 to avoid distress source: BDC - Current Ratio Calculator.

ISED data highlights working capital challenges for many Canadian SMEs source: Key Small Business Statistics - ISED.

In Forest City manufacturing or service firms, ratios below 1.2 often tie to seasonal fluctuations or slow collections.

Common Pitfalls and Fixes

Overstocked inventory → Ties up cash unnecessarily.

High receivables → From lax credit terms.

Short-term debt overload → From unplanned borrowing.

Improvement Strategies:

Forecast cash flow quarterly.

Accelerate collections with incentives.

Manage payables wisely without straining relationships.

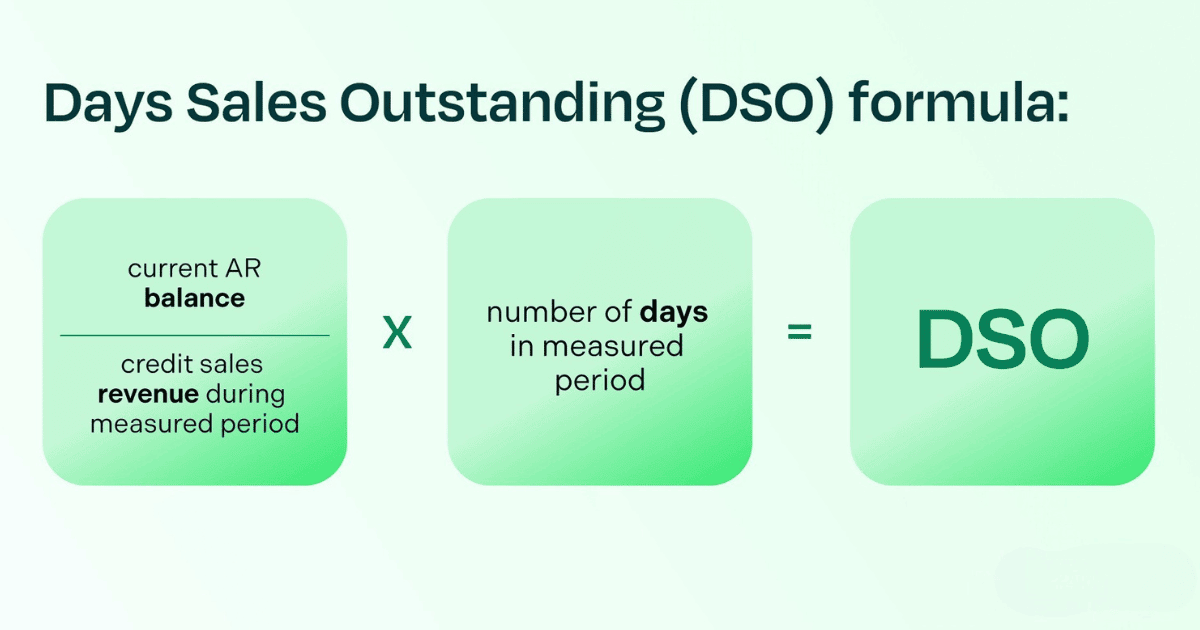

The Third Number: Your Days Sales Outstanding (DSO)

DSO = (Average Accounts Receivable / Total Credit Sales) × Number of Days

This tracks average days to collect payments post-sale. Lower is better.Why DSO Is a Cash Flow Game-Changer

High DSO locks cash in receivables, limiting reinvestment or tax payments. It often reveals credit policy or collection issues.

For income tax and corporate tax, strong DSO ensures cash for quarterly instalments, avoiding CRA penalties.Canadian Benchmarks

Many businesses aim for under 45 days. BDC tools help benchmark collection periods source: BDC - Accounts Receivable Benchmarking.

Studies show averages around 50-60 days for Canadian SMEs, varying by sector.

Local London, Ontario businesses in B2B services often see higher DSO from net-60 terms.

How to Reduce Your DSO

Tighten credit policies → Require deposits or shorter terms.

Automate invoicing and reminders.

Offer early-payment discounts (2% net 10).

Follow up proactively on overdue accounts.

How These Numbers Interconnect and Drive Tax Planning

These metrics form a complete picture:

High margins fund growth without eroding profits.

Solid current ratio provides resilience.

Low DSO delivers reliable cash flow.

Together, they qualify many clients for the federal Small Business Deduction (9% rate on first $500,000 active income for CCPCs) source: CRA - Corporation Tax Rates.

Passive income can reduce eligibility, so we integrate tax planning to keep income active.

At Bhundhoo Tax, we go beyond income tax preparation—we offer virtual accountant support, compilation engagements, and fractional CFO guidance to optimize these numbers year-round.

Next Steps: Let's Review Your Three Numbers

If you're a business owner in London, Ontario, the Forest City, or anywhere in Canada searching for an "accountant near me" or expert tax planning, share your gross margin, current ratio, and DSO in a no-obligation consultation.

We'll benchmark them, identify opportunities, and create a roadmap for stronger profitability and tax efficiency.

Contact Bhundhoo Tax today—your strategy starts with knowing these numbers inside out.

Keywords: CPA London Ontario, Accountant London Ontario, Income Tax London Ontario, Forest City Accountant, Accountant near me, Virtual Accountant Canada, Fractional CFO Canada, Compilation Engagement, Corporate Tax Planning, Tax Planning Canada, Small Business Financial Metrics