In the fast-paced world of Canadian business, scaling up sales often feels like the ultimate win. You've landed new clients, expanded your product line, and watched revenue climb month after month. But then reality hits: your bank account isn't reflecting that growth. Expenses are piling up, cash is tight, and you're left wondering, "Where did all the money go?" This silent killer—known as the profit-cash flow mismatch—is a profit problem no one talks about, yet it derails countless businesses every year according to insights from the Business Development Bank of Canada (BDC) source: BDC.ca - Taking Control of Your Cash Flow.

At Bhundhoo Tax, we've seen this scenario play out time and again with our clients across Canada. As a leading tax advisory firm specializing in small to medium-sized enterprises (SMEs), we help business owners navigate not just taxes but the underlying financial pitfalls that threaten profitability. In this in-depth guide, we'll unpack why increasing sales doesn't always translate to more cash, explore common causes, highlight compliance risks, and share best practices to turn things around. If you're a Canadian business owner grappling with cash flow issues despite high sales, this is your roadmap to sustainable profits.

Understanding the Profit-Cash Flow Disconnect

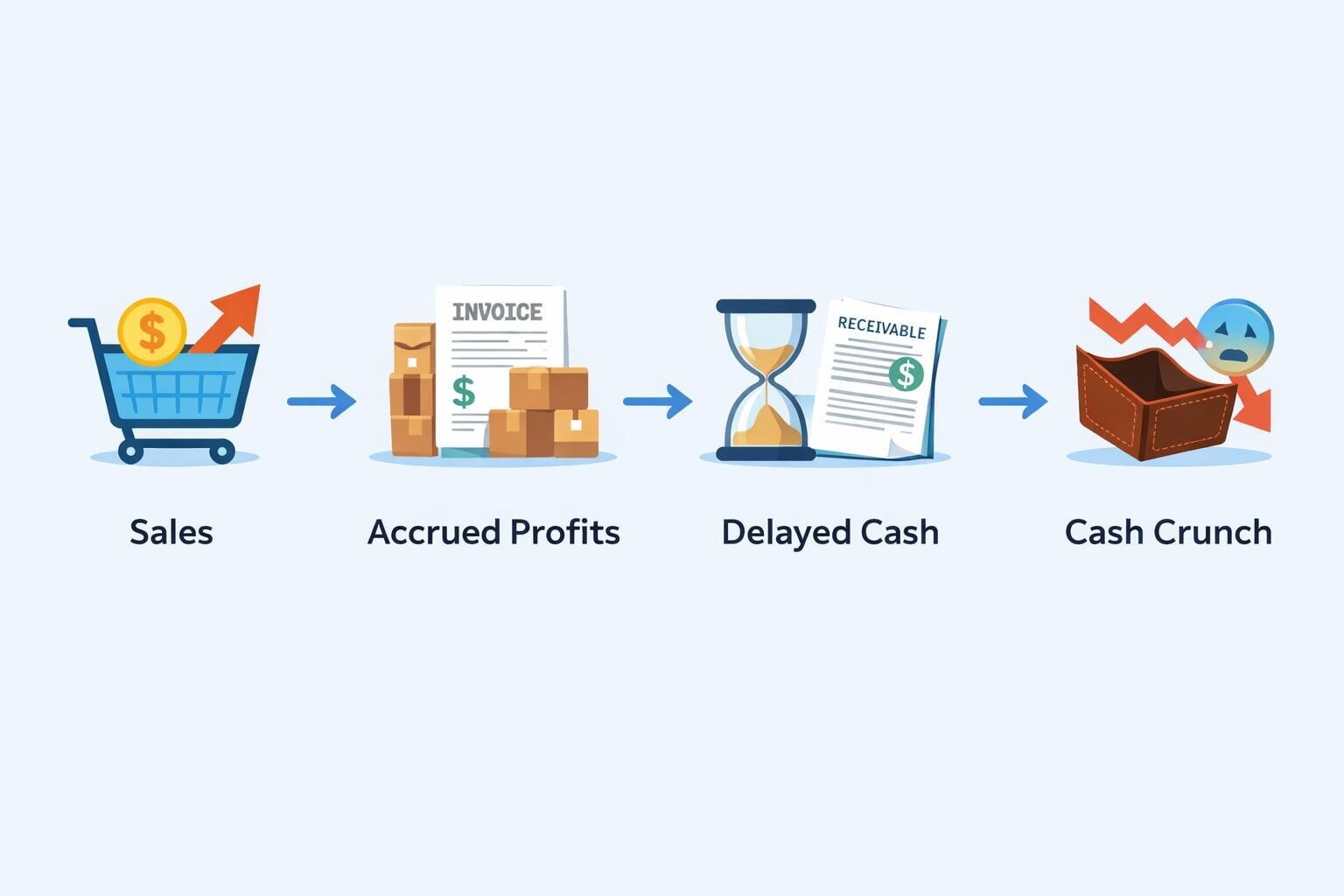

At its core, the profit problem stems from a fundamental difference between accounting profits and actual cash flow. Profits are calculated on an accrual basis—recording revenue when earned and expenses when incurred, regardless of when money changes hands. Cash flow, on the other hand, tracks the real movement of money in and out of your business.

Imagine this: Your sales team closes a big deal in December, boosting your year-end profits on paper. But if the client pays net 60 days, that cash won't hit your account until February. Meanwhile, you've already paid suppliers, employees, and overhead to fulfill the order. Result? Stellar sales figures, but a strained bank balance. This mismatch is exacerbated in growing businesses where inventory builds up, accounts receivable balloon, and capital expenditures rise to support expansion.

Key factors contributing to this issue include:

Delayed Payments from Customers: Extended credit terms might win deals, but they tie up cash in receivables. According to key small business statistics from Innovation, Science and Economic Development Canada, many SMEs face challenges with payment delays source: Key Small Business Statistics.

Inventory Overload: Scaling sales often means stocking more goods. If demand forecasts are off, you're left with tied-up capital in unsold inventory, eating into cash reserves.

Rising Operational Costs: More sales mean more hires, marketing spends, and overhead. These upfront expenses can outpace incoming revenue, creating a temporary (or chronic) cash crunch.

From a tax perspective, this disconnect can be deceptive. Profits show up on your income statement, triggering tax liabilities even if cash is scarce. Without proper planning, you could owe taxes on "phantom income" while struggling to pay bills. The Canada Revenue Agency (CRA) provides resources on managing business finances to align with tax obligations source: CRA - GST/HST for Businesses. At Bhundhoo Tax, we emphasize proactive tax strategies to mitigate this, such as optimizing deductions for inventory and bad debts under the Income Tax Act.

Common Pitfalls Businesses Overlook

Many Canadian entrepreneurs chase top-line growth without addressing the underlying mechanics of profitability. Here are the most overlooked pitfalls that turn booming sales into cash flow nightmares:

Poor Accounts Receivable Management: Offering generous payment terms to attract customers is common, but without follow-up, invoices go unpaid. Late payments are a widespread issue impacting small business cash flow.

Uncontrolled Expenses: As sales rise, so does the temptation to spend. New equipment, larger offices, or aggressive hiring can inflate costs faster than revenue. Without budgeting, variable expenses like marketing or commissions erode margins.

Ignoring Working Capital Needs: Growth demands investment in working capital—the funds needed for day-to-day operations. Failing to forecast this leads to borrowing at high interest rates or dipping into personal savings. The BDC offers guidance on working capital strategies for Canadian SMEs source: BDC.ca - Working Capital.

Tax Blind Spots: High sales boost taxable income, but if cash is locked in receivables, paying taxes becomes a burden. Overlooking eligible deductions (e.g., for R&D via SR&ED credits or home office expenses) compounds the problem. Canadian businesses must also navigate GST/HST remittances on sales, even if payments are delayed source: CRA - GST/HST for Businesses.

The Hidden Compliance and Risk Factors

Beyond the immediate cash squeeze, the profit-cash flow mismatch poses serious compliance risks that can escalate quickly in the Canadian regulatory environment:

Tax Penalties and Audits: Overstated profits without corresponding cash can lead to underpayment of taxes if deductions aren't maximized. The CRA may audit if discrepancies appear in your returns, resulting in penalties plus interest source: CRA - Interest and Penalties.

Debt and Financing Challenges: Relying on loans to bridge cash gaps increases interest expenses, reducing net profits. Poor cash flow also hurts credit scores, making future financing costlier or unavailable.

Legal and Operational Fallout: Delayed supplier payments can strain relationships or trigger late fees. In extreme cases, it leads to lawsuits or bankruptcy. Insolvency statistics from the Office of the Superintendent of Bankruptcy highlight the impact of financial distress on Canadian businesses source: OSB - Statistics and Research.

At Bhundhoo Tax, we stress that compliance isn't optional—it's a safeguard. By aligning your accounting practices with CRA regulations, you avoid surprises and free up resources for growth.

Best Practices to Solve the Profit Problem

The good news? This issue is solvable with disciplined strategies tailored for Canadian businesses. Here's how to ensure more sales mean more money in the bank:

Implement Robust Cash Flow Forecasting: Use tools like QuickBooks or Excel to project cash inflows and outflows weekly. Factor in seasonal trends and payment cycles to anticipate shortfalls. Resources like BDC's cash flow guides can help source: BDC.ca - Cash Flow Management.

Tighten Accounts Receivable: Shorten payment terms, offer early-payment discounts, and automate invoicing with reminders. Consider factoring services for immediate cash from receivables, such as those offered by providers like Accord Financial source: Accord Financial - Factoring.

Optimize Inventory Management: Adopt just-in-time inventory to minimize holding costs. Regular audits prevent overstocking, freeing up capital.

Control Expenses Ruthlessly: Categorize costs into fixed and variable, then trim non-essentials. Negotiate with suppliers for better terms and review contracts annually.

Leverage Tax Planning: Work with experts like Bhundhoo Tax to defer taxes legally, claim all deductions (including capital cost allowance), and structure your business for efficiency (e.g., incorporating to access the small business deduction). Quarterly tax estimates prevent year-end shocks source: CRA - Corporation Payments.

Build a Cash Reserve: Aim for 3-6 months of operating expenses in savings. Reinvest profits strategically rather than spending them all. Futurpreneur provides templates and guidance for startups on cash flow management source: Futurpreneur - Cash Flow Template.

Conclusion: Turn Sales Into Sustainable Success

The profit problem—more sales but no money—is a silent epidemic in Canadian business, but it doesn't have to define your journey. By understanding the disconnect, avoiding common pitfalls, and implementing smart practices, you can transform growth into genuine financial health.

At Bhundhoo Tax, we're more than tax preparers; we're partners in your profitability. If you're facing cash flow challenges despite rising sales, contact us today for a complimentary consultation. Let's uncover the hidden issues and craft a tax-optimized plan that puts more money back in your pocket.

Keywords: profit problems in business Canada, cash flow issues despite high sales, improving business profitability, tax strategies for cash flow Canada, small business financial management