This is a lengthy read, not meant for skimming, but for being a thorough source of everything related to the increased Lifetime Capital Gains Exemption and its benefits for small business owners.

Introduction

The Lifetime Capital Gains Exemption (LCGE) is a powerful tax tool designed to encourage entrepreneurship by allowing individuals to shelter capital gains from the sale of certain assets. In Canada, this exemption applies to qualified small business corporation (QSBC) shares, as well as qualified farm or fishing properties, providing a tax-free buffer on gains up to a specified limit (source: Canada Revenue Agency - Capital gains deduction). For 2026, the LCGE has been increased to 1,275,000, following the bump to1.25 million in 2024 and resuming indexation to inflation, offering significant relief to small business owners planning exits or successions (source: Investment Executive - Essential tax numbers: Updated for 2026).

This increase means that eligible owners can exclude up to $1,275,000 in capital gains from their taxable income, effectively halving the taxable portion at the 50% inclusion rate and resulting in substantial tax savings. For small business owners in London Ontario—the Forest City—where local enterprises in manufacturing, services, and agriculture thrive, this enhancement aligns perfectly with succession planning amid economic recovery. At Bhundhoo Tax, as your local CPA and accountant near me, we help clients leverage this through comprehensive tax planning and corporate tax strategies.

Without proper utilization, however, owners risk missing out on these benefits, leading to unnecessary income tax liabilities. The CRA emphasizes the importance of meeting strict criteria, and failing to do so could trigger reassessments. In short, the increased LCGE exists to reward long-term business investment, ensuring that owners in competitive markets like the Forest City can transition assets tax-efficiently while supporting family legacies or retirement goals.Eligibility and Types of Assets Qualifying for the LCGE

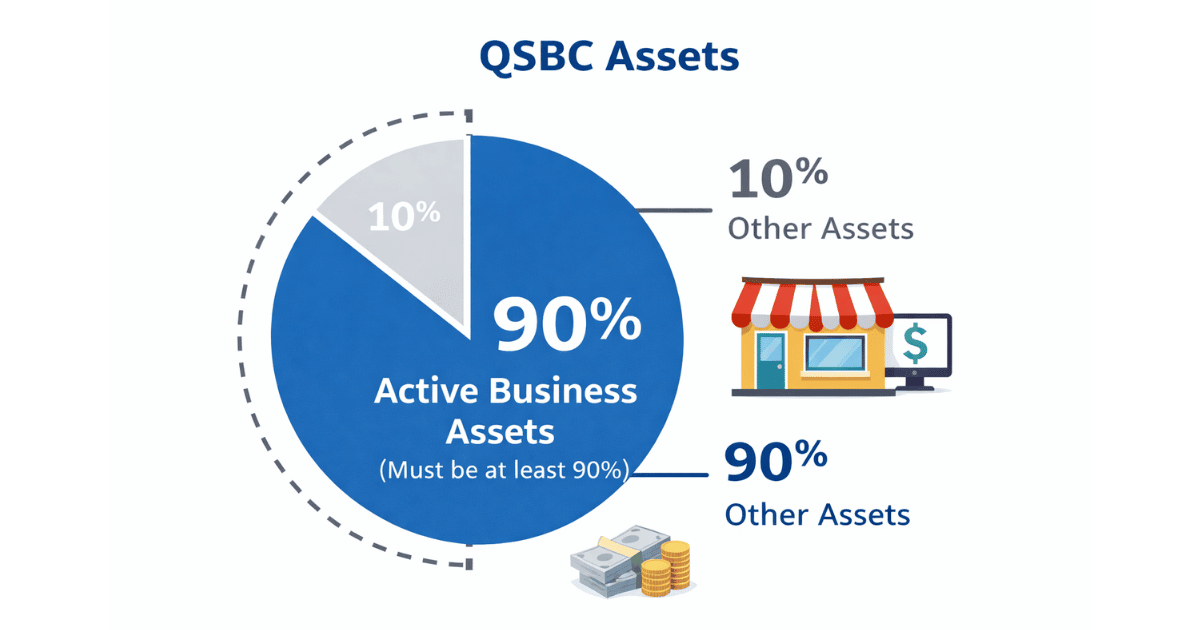

To benefit from the increased LCGE, the assets must meet specific definitions under the Income Tax Act. Primarily, this includes shares in a QSBC, where at least 90% of the corporation's assets are used in an active business in Canada during the 24 months prior to sale (source: CRA - Qualified small business corporation shares). Farm or fishing properties also qualify if they are actively used in those operations, providing a lifeline for rural entrepreneurs in regions surrounding London Ontario.

The tax treatment hinges on the asset's active use: passive investments or excess cash can disqualify shares, requiring careful purification to maintain eligibility. For instance, if a corporation holds real estate not integral to operations, those assets must be minimized or restructured. This is where corporate tax planning becomes essential, as owners may need to dividend out non-qualifying assets or reorganize holdings.

In the context of family-owned businesses common in the Forest City, the LCGE can be multiplied across spouses or family members, potentially sheltering millions in gains. The 2026 increase to $1,275,000 per individual amplifies this, but only for those who proactively ensure compliance. Business owners should note what does not qualify: publicly traded shares, rental properties without active involvement, or corporations with significant passive income streams are excluded, emphasizing the need for ongoing tax planning.

It is important to highlight that the LCGE is a lifetime limit, cumulative across all claims. For example, if an owner previously claimed $500,000 on a partial sale, the remaining exemption applies to future dispositions. In practice, owners often work with their accountant to appraise assets and confirm eligibility, using tools like compilation engagements to document fair market values. This structured approach ensures the full benefit of the increased limit is realized without surprises.

(Note: The LCGE was historically lower, around 1 million before the 2024 adjustment. The increase to1.25 million effective June 25, 2024, with indexation resuming in 2026, reflects policy efforts to support small businesses amid economic pressures (source: Department of Finance Canada - Budget measures). This adjustment does not alter core eligibility but enhances the financial upside for compliant owners.)Common Planning Challenges with the LCGE

Maximizing the increased LCGE requires vigilant planning, yet many small business owners encounter obstacles that diminish its value. A frequent issue is asset contamination: corporations accumulating non-active assets like investments or surplus cash over time, which fail the 90% active business test. For example, a London Ontario service firm might hold extra real estate for future expansion, but if not actively used, it could disqualify the shares, leading to lost exemptions.

Incomplete records pose another challenge. Throughout ownership, maintaining documentation of asset use is crucial, but lax bookkeeping—such as not separating personal and business expenses—creates gaps. High turnover in family businesses or mid-year changes in operations can further complicate this, making it hard to prove 24-month eligibility at sale time. Without a clear trail, the CRA may deny claims, forcing owners to pay full income tax on gains.

Misunderstanding purification strategies is common too. Some owners assume all corporate assets qualify, but only those integral to active operations count. For instance, excess cash from profitable years must be distributed or reinvested to avoid dilution. Failing this leads to partial disqualifications, where only a fraction of gains are exempt. Owners must clarify asset roles: operational equipment qualifies, while speculative holdings do not. Overlooking this can mean forfeiting thousands in savings under the 2026 limit.

Lack of forward planning exacerbates issues. Best approached years in advance, yet many delay until sale negotiations, missing opportunities to restructure. If records show $X in active assets but discrepancies arise, it's a red flag for errors. In summary, pervasive challenges include asset mix issues, poor documentation, and eligibility knowledge gaps. Businesses ignoring these often scramble during sales or face CRA scrutiny later.Compliance Risks of Underutilizing or Misapplying the LCGE

Claiming the increased LCGE is more than a tax perk—it's tied to strict compliance, and errors can expose owners to significant risks. Inaccurate applications invite CRA audits, where the agency verifies QSBC status and asset tests (source: CRA - Audit programs). If a review reveals non-qualifying assets, consequences ripple: owners may face reassessments, adding taxable gains retroactively.

CRA audits often uncover broader issues, like misreported corporate tax or undeclared income, leading to adjustments across multiple years. Studies show high non-compliance rates in capital gains claims, with over 70% of reviewed cases requiring corrections (source: CRA - Evaluation reports). A LCGE error might signal deeper problems, prompting full business audits and reassessing personal income tax.

Penalties and interest compound the pain. While the LCGE is elective, invalid claims trigger underpayment assessments, with interest accruing from original filing dates. Significant negligence could incur penalties up to 50% of unpaid taxes under the Income Tax Act (source: CRA - Penalties and interest). Repeat issues heighten punitive risks, burdening owners with taxes that could have been avoided.

From a business perspective, compliance failures erode trust and complicate successions. Understated exemptions mean missed savings, discovered during audits and straining finances. Overclaims lead to denials and repayments, administratively burdensome. In worst cases, broad misreporting invites deeper scrutiny, harming reputations in tight-knit communities like the Forest City.

In essence, proper LCGE use is part of broader tax obligations. Mishandling not only risks financial penalties but heightens audit exposure and disrupts personal finances. CPA professionals advising London Ontario businesses must prioritize these to safeguard clients during 2026 transitions.Best Practices for Maximizing the LCGE

To harness the increased LCGE, small business owners should adopt proactive strategies. Integrate annual reviews into tax planning, assessing asset composition to ensure 90% active use. Modern accounting software can track this, flagging non-qualifying items early.

Obtain professional valuations regularly. Work with your accountant or fractional CFO to appraise shares and assets, documenting active status. This prevents surprises and supports claims.

Educate stakeholders: Ensure family or partners understand LCGE rules. Provide guides on maintaining active operations, reducing errors from misaligned decisions.

Routine purification: Don't wait for sales—perform quarterly checks to dividend out passive assets. Compare holdings against CRA criteria, catching issues promptly.

Maintain thorough documentation: Store records of asset use, invoices, and operations. Proactively summarize for CRA inquiries, mirroring best practices in other tax areas.

Review corporate structures: If using holding companies, ensure they align with QSBC rules. Involve a CPA in changes to preserve eligibility.

By implementing these, owners reduce risks and maximize the $1,275,000 exemption. The approach: be detail-oriented, verify regularly, document everything.

Owners following these find sales smoother, well-positioned for CRA reviews. Moreover, it enhances overall corporate tax efficiency.Conclusion

The increased LCGE may seem niche, but it holds profound benefits for small business owners, sheltering up to $1,275,000 in gains tax-free. This guide highlighted its purpose: rewarding active entrepreneurship through exemptions on QSBC shares and farm/fishing properties.

We examined eligibility, reaffirming active asset requirements and the boost from 2024's increase with 2026 indexation.

Common pitfalls like asset contamination, poor records, and eligibility misunderstandings can undermine benefits, exposing owners to risks including audits, reassessments, and penalties if claims falter.

For CPA professionals overseeing tax planning in London Ontario, key takeaways are clear. First, precision is vital: confirm qualifying assets accurately. Second, systems support success: use tools for ongoing compliance. Third, adopt a proactive mindset: the LCGE is a planning tool, and negligence carries consequences.

CRA enforcement underscores diligence (source: CRA - Audit evaluations).

In conclusion, owners should integrate LCGE strategies into routines. Through purification, documentation, and expert guidance, businesses ensure maximal benefits. This upholds compliance and empowers Forest City entrepreneurs to thrive tax-efficiently.

At Bhundhoo Tax, as your virtual accountant or local accountant near me, we're here for compilation engagements and beyond. Contact us to optimize your 2026 gains.

Keywords: CPA, Accountant, Income Tax, London Ontario, Forest City, Accountant near me, Virtual Accountant, Fractional CFO, Compilation Engagement, Corporate Tax, Tax Planning